- April 22, 2024

-

-

Loading

Loading

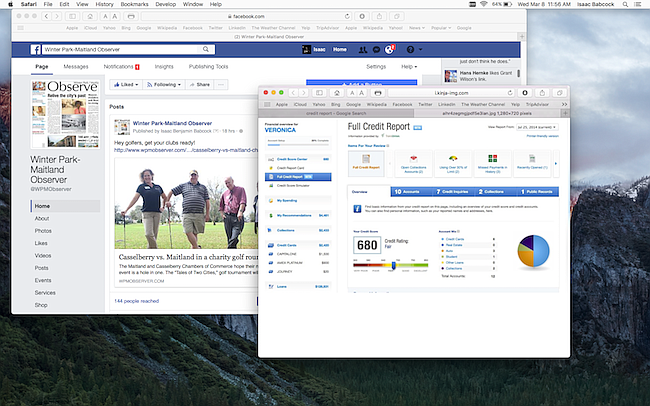

Social media has infiltrated every aspect of our culture and lives. These days it’s almost an oddity to discover someone without any social media accounts even if they are using them for business purposes. I’ve seen several think pieces circulate the usual online channels declaring that lenders will be peering into your personal lives via Facebook and Snapchat to determine whether you are credit worthy or not. I was incredulous when I first heard this and decided to chat with a trusted lending partner to verify whether or not I needed to check my buddy’s bank accounts before adding them to my friends list. Dan Felix is the AVP of Mortgage Lending and Mortgage Services for Fairwinds Credit Union and a former underwriter so he knows the ins and outs of how buyers get qualified (or don’t) intimately.

Here’s what he had to say about your Facebook page and its correlation to your loan approval along with some other things to expect if you are buying a home in 2017.

No, lenders are not looking at your Facebook page to determine if they will give you a home loan or not. In fact your social media activity has no bearing on your creditworthiness at all. So go ahead and add your friends regardless of their financial status; your lender simply wont care. What lenders do care about are more relevant things such as debt to income ratio, assets, income and credit scores. Focus on the usual things you would when prepping to purchase a home by paying your bills on time and keeping your debt low and you’ll be on the right track. Save some money for that down payment too!

What we can expect to see in 2017 and beyond is lenders looking at what is called “Trended Data”. Trended Data gives lenders the ability to see whether you carry a balance on your credit card on a regular basis or if you pay off your balance in full each month. CreditTechnologies.com clarifies further that a person paying off their balance in full every month is a “transactor” and more likely to be creditworthy than a “revolver” who only pays the minimum balance. Further, while these more detailed data reports are now available and being utilized in a buyers overall review Fannie and Freddie will not treat consumers differently based on if they pay credit cards in full monthly or not at this time. That may however change sometime in the not so distant future so it’s something to keep in mind looking down the road. While it’s almost always better to pay any credit cards in full whenever you can this my be the extra motivation you need to finally pay off that balance from when you remodeled your kitchen or splurged on that watch!

In interest rate news, rates are headed back up. The Fed has been mentioning they plan on raising rates for a little while now. We’ve had historically low rates for years and if you are on the threshold of being able to qualify for that dream house it’s advisable not to wait if you can act now. As of this column’s writing mortgage loan rates for a 30 year fixed rate loan are in the 4’s and rates for 15 year fixed rate loans are in the 3’s. Phenomenal numbers like this have enabled many first time buyers and buyers who are on the cusp on qualifying based on factors such as debt to income ratios to buy homes. The good news here is rates have already been raised slightly in anticipation of the Fed’s announcement. Rates may gradually creep into the 5’s in the coming year and even that is a great interest rate when you look at the big picture and the history of how high they have been in the past. If however you are looking to purchase that dream home in your dream neighborhood and you’re just barely making the numbers work buying sooner than later is in your favor. Currently in Orlando and surrounding areas such as Winter Park Maitland and farther north into Seminole county inventory of available homes is low and pushing prices in most every area up. Great news if you are selling for sure. There is no magic spell to guarantee whether that inventory will escalate significantly enough to offset rising prices however, and those two factors are key when it comes to the affordability of a home.

In closing, don’t fret about friends on face place, they can’t hurt your chances of buying that new home. Rates are likely to climb in 2017 and inventory locally is likely to remain low making it an overall sellers market. Focus on the traditional factors of creditworthiness when applying for a home loan and consider paying off those credit cards as lenders are now taking a closer look at that behavior.